Blogs

Certification from put membership they can be handy for preserving on the enough time-identity requirements otherwise probably making a top interest rate than your perform having a checking account. When you use Cds within your deals method, it’s you are able to to use them to performs up to FDIC insurance rates restrictions thanks to CDARS. The fresh Government Put Insurance policies Firm (FDIC) assures places listed in savings membership, currency industry account, examining profile and you may Cds. It means so long as you bank in the a covered business, your money is secure in the eventuality of a bank inability—at the very least to some extent. Even as we discussed earlier, really web based casinos need you to create at least $10 when transferring for you personally. All of our pro editors simply have managed to find one no minimal deposit a real income internet casino in the usa.

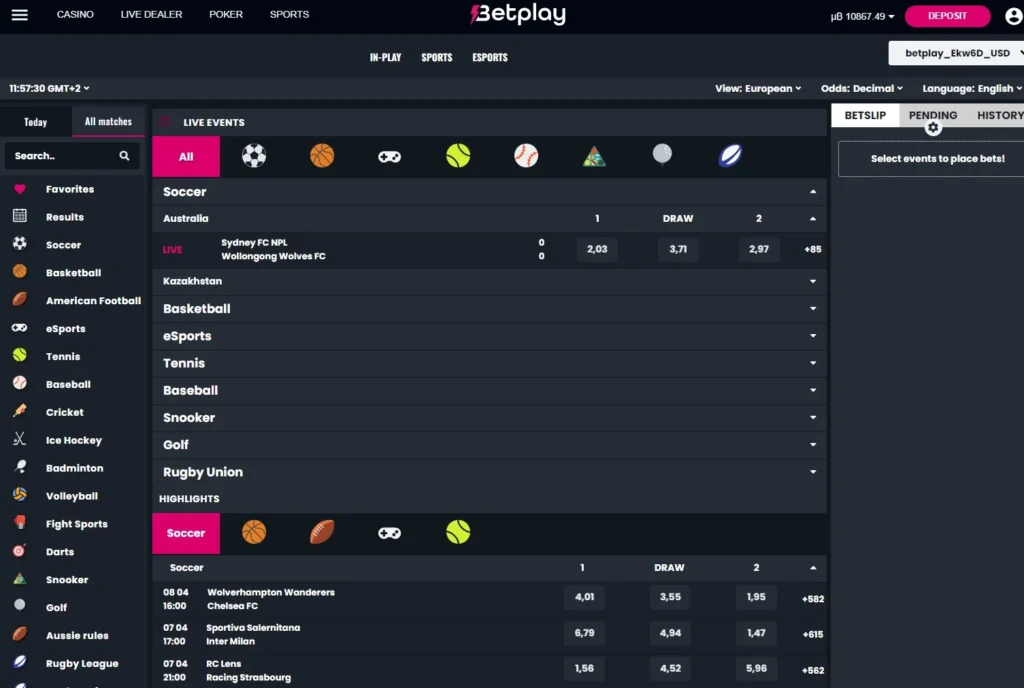

Dumps inside the a financial organization pursuant to the conditions of this subdivision is going to be built in a financial company having a place out of company in the state. Keep reading to find the best gambling internet sites having reduced minimum dumps. Subscribe any webpages that meets the gaming needs to delight in a great quality on the internet sense. The required $step one put gambling enterprises for new people render a pleasant extra one you could take advantage of when you sign up.

Examining Profile

However,, a corporate having frequent average-to-large-measurements of transactions might not hunt unlikely to receive otherwise shell out $10,100000 in the inspections, even if the number remains said for the Irs. To enhance FDIC visibility past $250,000, depositors has various other possibilities in addition to believe account. We must discovered the request at the least three (3) working days through to the percentage is placed getting produced.

Rather, he or she is insured because the Single Membership deposits of one’s manager, placed into the newest customer’s other Solitary Membership, if any, at the same financial plus the full insured to $250,000. Such, in the event the a firm has each other an operating account and a reserve account in one lender, the new FDIC create put both accounts together and you can guarantee the newest deposits to $250,one hundred thousand. Including deposits are insured individually from the private deposits of the company’s people, stockholders, couples otherwise players. Changing the use of “or,” “and” or “and/or” to separate your lives the fresh brands from co-people inside a combined account name, as well as doesn’t change the quantity of insurance policies provided. If the all these requirements is satisfied, for each and every co-owner’s offers of any combined account that she or he possess at the same covered lender try added together with her as well as the overall is insured up to $250,000. A shared Account try in initial deposit owned by a couple of those with no beneficiaries.

Well-known $step one Deposit Casino Extra Problems

This can be a personal Security amount, driver’s license, otherwise bodies-given ID. This information have to be gotten whether or not the depositor features a merchant account in the acquiring financial institution. Government rules requires banking companies to report dumps greater than $10,one hundred thousand. No matter where the money originated in or as to why they’s becoming transferred, the financial need declaration they by submitting a great Money Exchange Statement (CTR). For each recipient is approved for approximately $250,100 within the FDIC exposure for each account proprietor.

But not, of numerous public gambling enterprises offer each day log on bonuses, which provide several Gold coins and frequently a good Sweeps Money. Of numerous $step 1 minimum deposit bonuses is only able to be taken on the https://happy-gambler.com/vmbet-casino/ particular video game. Make sure you investigate small print of every campaign meticulously understand which online game be eligible for your added bonus. Extremely internet casino bonuses include betting criteria anywhere between 1x in order to 100x. It means you must choice a certain amount before withdrawing the new bonus.

- Keep in mind that inside things of a bank failure where a good depositor currently have deposits in the obtaining lender, the new six-day sophistication months discussed could connect with its dumps.

- If the declaration to the basic lender is complete, start once more along with your next financial and so on, if you don’t features research for every financial in which you has deposit profile.

- Bankrate.com is actually a separate, advertising-supported blogger and you may analysis services.

- Crown Gold coins is also really big that have incentives for brand new and existing players and it has a modern every day log in bonus one to begins at the 5,000 CC.

- Downtown Vehicle parking Ass’letter, 95 Ariz. 98, 101 (1963) (quoting Domus Realty Corp. v. 3440 Realty Co., 40 N.Y.S.2d 69, (Special Identity 1943)).

Specific establishments have begun to give to $step three million away from FDIC insurance coverage.

We might will not open an account for any reason, and absolutely no reason. We are really not liable for any damages or obligations as a result of refusal away from a merchant account dating. Account owned by a comparable corporation, connection, or unincorporated connection however, designated for several intentions aren’t separately insured. A single-year Video game that have a performance of cuatro% APY brings in $500, while the exact same Video game with a-1% APY brings in $a hundred and another that have 0.10% APY earns $ten.

Sweepstakes local casino fee procedures

The Cds need $step 1,100 to start (otherwise $75,one hundred thousand for individuals who go for an excellent jumbo Computer game, and this will pay slightly large APYs). The financing relationship as well as doesn’t have a maximum matter you could setup a good Cd. Alliant doesn’t provide people specialization Cds such as zero-punishment otherwise knock-upwards Dvds. You can now register Alliant Credit Relationship; registration is not minimal. It can be beneficial to definitely keep your cash and you may debit card PIN secure while using the an atm in public places. Selecting an automatic teller machine inside the a well-lit area and you may being conscious of their landscaping may go a good way on the being secure making a cash deposit or detachment.

Using Cutting edge Cash Put form finances is approved to own FDIC insurance. And some federal and state-chartered borrowing from the bank unions render more personal insurance because of Excessive Display Insurance, an insurance coverage business in the Kansas. However, as opposed to visibility from the NCUSIF, that it insurance is not protected because of the U.S. regulators. Yet not, not that which you at the financial is part of FDIC defense. Funding issues for example stocks, bonds and you can mutual fund aren’t secure, even though you bought her or him via your lender. The newest FDIC along with doesn’t insure cryptocurrencies, the newest belongings in safe deposit packages, insurance, annuities otherwise municipal securities.

Such as, the newest FDIC makes sure places owned by a good homeowners’ relationship in the you to insured bank up to $250,100000 as a whole, maybe not $250,one hundred thousand for each person in the fresh organization. For Believe Account, the word “owner” also means the newest grantor, settlor, or trustor of your faith. “Self-directed” implies that bundle professionals feel the directly to lead how the money is invested, for instance the power to direct one to dumps be put in the an FDIC-insured financial. At the most significant banking companies, cash places is credited immediately however if you are introducing more than simply $5,100, the financial institution may decide to hold on a minute temporarily. Additional issue to be aware of is exactly what the new bank’s financing availability rules is actually for dollars dumps.

A lot more online casino resources

Even though many offers require a tiny money, internet casino bonuses will vary centered on their actions. Such as, having a “100% match up so you can $step one,000” greeting promotion, you could potentially found an advantage comparable to the minimum deposit expected. The new service is even revising standards to have informal revocable trusts, known as payable on the demise profile. In past times, those individuals accounts must be called which have a phrase such “payable on the demise,” to access trust visibility limits. Now, the fresh FDIC will not have that needs and you may as an alternative simply need financial info to identify beneficiaries getting sensed everyday trusts.

And maintain in mind you to definitely a good Video game’s fixed rates may not always be adequate to include your dollars facing rising prices. The fresh federal deposit insurance coverage restriction resided from the $100,100000 for almost 3 decades prior to Congress ultimately elevated it in the response to the newest terrible economic crisis while the Great Anxiety. It’s supposed to assures your fellow people that financial offers FDIC put insurance, which covers the dumps as much as applicable judge limitations should the financial go out of business. Pursue and fees the organization people an exchange payment for cash places in excess of the new month-to-month restrict. When you’re we have witnessed a speak of banking institutions charging you customers fees to own and then make bucks places, none of one’s biggest banking companies has implemented this type of coverage to date. Of a lot brokerages supply brokered Cds away from other banking institutions nationwide, so it’s an easy task to sit in this FDIC limits while you are possibly earning better prices.