If that’s the case, go into the number out of Setting 8990, Region II, line 32, to have EBIE. Were about line the interest properly allocable so you can debt on the assets kept to have financing intentions. Assets held to have financing boasts property which makes earnings away from interest, returns, annuities, otherwise royalties perhaps not derived regarding the normal course of a swap or business. Assets stored to possess funding also includes possessions that makes development perhaps not derived regarding the typical span of a swap or organization away from the new mood of assets that produces among those income or is actually stored to own investment. If the an upper-level partnership’s allocated part is equivalent to otherwise below 2.5 times the sum for each greatest member’s associated base, following one after that higher-tier connection otherwise higher-level S business need to however see whether the new disallowance code enforce to help you their assigned portion. In case your partnership made a professional conservation sum under part 170(h), also include the new FMV of one’s fundamental assets pre and post the new donation, and the type of court desire discussed, and you may define the brand new conservation objective furthered from the donation.

Although not, the entire unrecaptured point 1250 get must be spent on the fresh payments gotten from the sales. To do this, the relationship need essentially eliminate the new acquire allocable to every installment payment as the unrecaptured area 1250 acquire up until the for example get has become included in full. But not, in the event the somebody try an enthusiastic IRA, enter the determining level of the new custodian of your IRA.

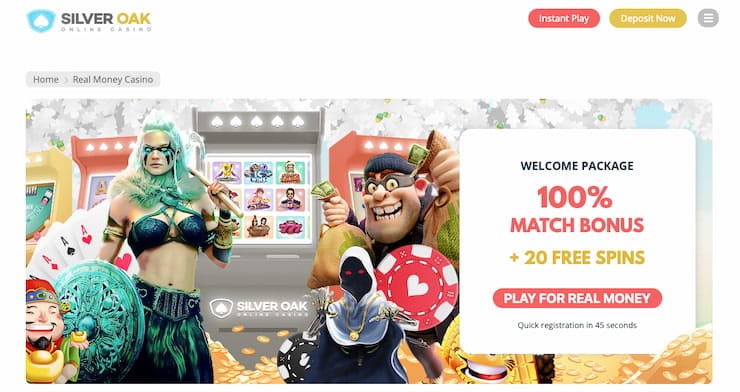

Online casinos safe – Yahoo Chrome

This can be like the circumstances regarding the Trobriand Islands from Papua The new Guinea, in which you can find profile out of chiefs purchasing ritual experts to help you curse those who have damaged specific regulations or society. There are also of several contexts international where an excellent ritual expert could possibly get do cursing for a paying customer, and these ritualists get simultaneously provide functions for recuperation, divination, or perhaps to avoid the new curses of other people. The newest distinction between the brand new malevolent witch or other form of routine professional is not always clear-slashed. A familiar religion from the witches is that they cause its designed harm through the performance from routine acts, within the English normally called spell-casting. A repeated tip through the of numerous countries, along with Polynesia, Melanesia, Southern area China, Africa, and North america, would be the fact witches could harm men by gaining access to the complete clippings, tresses, otherwise real waste.

Register to help you Yahoo Sound

Meanwhile, some individuals residing very early modern teams probably performed take part in cursing, and you may given the pervasive belief in the facts of Satan it can be done one to many of them regarded as on their own as being inside league to the Demon. Additionally, it is noticeable one some of those accused have been employed in routine, religious, otherwise individuals life style you to the accusers misinterpreted while the Satanic witchery, since the try the truth on the benandanti, therapists out of a great visionary culture energetic in the Friuli, Italy. The methods you to definitely teams stop witchcraft and you can deal with suspected witches can differ generally. Possibly, witchcraft has been discovered as the a small problem that may largely be deflected by making use of amulets or any other effortless apotropaic tips. If an individual believes they have been cursed, they might consider a routine pro whom now offers actions in order to contrary the fresh bewitchment and sometimes to recognize the newest witch in control, often thanks to divination.

While the point 743(b) basis adjustments and you can income from guaranteed money aren’t within the partners’ taxation-foundation financing accounts, specific modifications could be necessary. If net income has income out of guaranteed money built to couples, get rid of such as money on line 7. The facts are identical as in Analogy 1, but as well as the points in this analogy, An excellent in addition to contributes possessions Y with an enthusiastic FMV away from $one hundred and you will a remaining income tax basis out of $0. When the Y were newly placed in solution, the depreciable lifetime might possibly be 10 years straight line.

In spite of the newest preceding, online casinos safe a collaboration that is, otherwise provides a department that is, a great QDD must document Function 1065. A small union is made under a state restricted relationship legislation and including at least one general partner plus one otherwise a lot more limited partners. A good examined 12 months try a partnership’s income tax season to which a collaboration adjustment relates. The new Taxpayer Costs of Rights describes ten first rights that taxpayers has when discussing the brand new Internal revenue service.

The brand new Irs try purchased serving taxpayers that have limited-English ability (LEP) by offering OPI functions. The brand new OPI Solution is actually a great federally financed system which can be available at the Taxpayer Advice Centers (TACs), most Irs workplaces, each VITA/TCE taxation go back website. Herbal witches are experts in the fresh magical and data recovery services out of plant life, tend to increasing their particular plants for usage within the means and you may cures.

Frank Baum’s 1900 novel The beautiful Genius out of Oz as well as 1939 motion picture adaptation, the spot where the envisioned Property away from Ounce hosts one another an excellent witches and bad witches. In the late 20th and you may early twenty-first many years, morally benevolent witches are very extensive within the fantasy fictional, such as Terry Pratchett’s Discworld courses, Jill Murphy’s The brand new Terrible Witch, otherwise J.K. The brand new increasing popularization of your proven fact that witches might be a good subsequently led to expanding variety of people that definitely experienced themselves getting witches. Only a few witches have to create routine serves in order to curse anyone, however. Specifically preferred within the Western and you will Main Africa and Melanesia try individuals beliefs on the witches whom result in spoil just because of the view otherwise wishes.

Of a lot English words terms have observed the definitions shift throughout the years—a thing that is real away from witchcraft and you will witch. Another, much larger knowledge of the word witch has arrived in order to cover a varied directory of someone said to impact supernatural otherwise occult forces regardless of its aim inside the performing this. Less than which definition, witchcraft can be utilized not only to explain somebody with one of these vitality to curse another, but also for those individuals influencing such as pushes to provide recovery, to engage in divination, or to lift the fresh curses of other people.

- Swamp witches come across the miracle regarding the wetlands and you can marshes, by using the novel elements of these environments.

- Faery witches have a tendency to utilize vegetation, crystals, and you can signs of one’s Fae to their traditions, cultivating a feeling of question and miracle.

- The fresh review regimen relates to all of the partnerships except if the relationship try an eligible union and you may elects out-by and then make a legitimate election playing with Plan B-dos (Setting 1065).

- Chrome previously used its now-deprecated SPDY protocol unlike simply HTTP127128 whenever chatting with server you to definitely back it up, such Bing characteristics, Twitter, Fb.

To have a different signal concerning the form of bookkeeping to own a agriculture connection that have a business companion as well as for other income tax advice for the facilities, find Pub. As well, partnerships one to meet the requirements out of (a) and you will (b) above are not needed to file Plan C (Mode 1065) otherwise Form 8916-A. A partnership submitting Form 1065 this is not necessary to file Plan M-3 can get voluntarily file Plan M-step 3 unlike Plan Meters-1.

Called customer service and you may literally the only thing it “ supervisor” ( which frequently is literally a statistic check out appease the people) you’ll manage for me personally are say disappointed. They couldn’t give myself a reason of as to why a refused purchase nonetheless took currency and that i still need to wait right until a few weeks to have it back.(3-5 working days, but honestly) don’t get that it app. It was literally my first time using them and once We repay Shein, I’m undoubtedly removing they. People information somebody that’s a great PTP may prefer to know if they match the fresh 90% qualifying money sample away from section 7704(c)(2). Someone must alert the connection of the position while the a PTP. In case your connection made a good noncash charity share, declaration the newest companion’s show of your relationship’s modified basis of the property to possess foundation restrict aim.

A limited companion is actually somebody in the a partnership molded less than your state restricted relationship legislation, whoever personal responsibility to own relationship expenses is limited to your number of money or any other possessions that partner shared or is expected to sign up to the partnership. Certain people in almost every other entities, such as residential otherwise international team trusts or LLCs that are classified as the partnerships, is generally treated while the restricted partners definitely objectives. Somewhere else inside the Anglophone societies, the fresh term of your witch was also implemented from the specific feminist females.

In lots of areas of Africa Pentecostal preachers have played a popular part inside the searching for and you can combating witches, a task which may be driven not only by legitimate faith as well as from the financial and you may reputational perks it does provide. The new laws and regulations to own official procedure had slowly insisted to the more requiring requirements away from evidence and shown an increasing question in the prevalent access to torture. The amount of acquittals for witchcraft grew, and you will courts turned into much more reluctant to initiate prosecutions. Higher judicial government many times strolled directly into end local witch hunts that they felt had gotten unmanageable. Expanding elite skepticism of your samples do at some point be joined because of the increasing skepticism concerning your expereince of living away from witchcraft in itself.

To have purposes of deciding the fresh QBI or accredited PTP things, UBIA away from accredited assets, plus the aggregate level of accredited REIT dividends, fiscal seasons-prevent partnerships are the issues on the taxation (fiscal) 12 months. Concurrently, the relationship should also report if or not any one of the deals otherwise companies are specified services deals otherwise businesses (SSTBs) and you will pick for the statement one positions or firms that try aggregated. The connection also needs to statement the QBI guidance stated to they because of the people entity where the relationship has a possession focus. Section 704(c) home is possessions which had a keen FMV that was either better or below the newest contributing partner’s adjusted basis during the time the house is actually triggered the relationship.